COVID-19 Updates

Coronavirus—Protecting you and our staff

We understand that everyone is concerned about coronavirus. And we are as well, which is why we are taking precautions to keep our clients and our staff safe.

While the threat of coronavirus exists, we are asking both clients and staff who feel unwell or have sick loved ones to refrain from visiting Tax & Business Consultants onsite. If you have tax documents to deliver or need to communicate with our team, please do so through your client portal or by Zoom.

In addition, we highly recommend that you visit the Nebraska Department of Health and Human Services website for current guidelines on good hygiene practices to prevent the spread of COVID-19 and other respiratory diseases:

Our main focus is the continued good health of everyone!

Please be sure to reach out to us with concerns or questions. We are here to help!

COVID-19 Support

Bipartisan Infrastructure Bill Ends Employee Retention Credit as of October 1, 2021

The H.R. 3684 – Infrastructure Investment and Jobs Act was passed by the Senate on August 12, 2021, the House of Representatives on November 5, 2021, and now awaits President Biden’s signature. Once signed, Section 80604 of this bill will amend the termination date of Employee Retention Credit in Section 3134 of the Internal Revenue Code of 1986 from January 1, 2022 to October 1, 2021 (or, in the case of wages paid by an eligible employer which is a recovery startup business, January 1, 2022).

The modification to the Employee Retention Credit removes business owners’ access to the expected fourth quarter credit for 2021 but may still be available to entities classifying as Recovery Startup Businesses until January 1, 2022.

Note: Recovery Startup Businesses are an entirely new category of Eligible Employers introduced by the American Rescue Plan Act and include any company that:

began operations after February 15, 2020, and,

has average annual gross receipts of $1,000,000 or less.

Our firm is diligently monitoring this information and we will provide accurate updates as soon as we are made aware of any possible options for business relief outside of Recovery Startup Businesses.

Employee Retention Credit extended and expanded

The Employee Retention Credit (ERC) was extended and expanded in March to go through Dec. 31, 2021, as part of the American Rescue Plan Act of 2021(ARPA). Originally, the ERC was enacted in March 2020 as part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act).

Originally, the ERC was a refundable payroll tax credit granted for full-time employees who were retained from March 13, 2020, to Dec. 31, 2020, during the temporary business shutdowns. The Consolidated Appropriations Act of 2021 (CAA) then expanded the ERC, by retroactively allowing employers (even those who had received a PPP loan) to claim the ERC. ARPA then extended the ERC further. Under the CARES Act, the amount of credit was 50 percent of qualified wages paid to the employee plus the cost to provide health benefits.

The ERC and the American Rescue Plan Act

The enhanced ERC under ARPA follows the more favorable 2021 rules originally enacted as part of the CAA. These rules include:

Lowering the threshold for meeting the “eligible employer” standard under the gross receipts test (requiring only a 20 percent decline in gross receipts compared to a 50 percent decline required for the 2020 ERC)

Raising the credit rate to 70 percent (from 50 percent in 2020)

Raising the maximum qualified wages to $10,000 per quarter (from $10,000 aggregate for all of 2020)

Raising the “small employer” limit to 500 full-time employees (compared to 100 full-time employees for the 2020 ERC)—a small employer is allowed to claim all wages paid during the eligibility period; while large employers can only claim the ERC for wages paid to employees not providing services

As a result, the maximum ERC per employee for 2021 is now $21,000 (unless the business qualifies as a recovery startup business and then maximum amount is $28,000), compared to $5,000 for the 2020 version of the ERC.

Expanded benefits under the new relief legislation

In addition, ARPA provides additional expanded benefits for the ERC—these two changes are only applicable to the third and fourth calendar quarters of 2021.

First, the ERC is now available for “Recovery Startup Businesses.” This provision is applicable to startup companies that opened a trade or business after February 15, 2020, with average annual gross receipts that do not exceed $1M.

Secondly, ARPA also provides an expanded ERC benefit to “Severely Financially Distressed Employers.” To qualify under this provision, an employer must suffer at least a decline of 90 percent gross receipts in the quarter compared to the same quarter in 2019.

If you have questions, please contact our team. We can help to determine if you qualify and then work with you to apply for the ERC.

HHS Provider Relief Funds Reporting Requirements

Department of Health and Human Services (HHS) Provider Relief Funds (PRF) Reporting Requirements

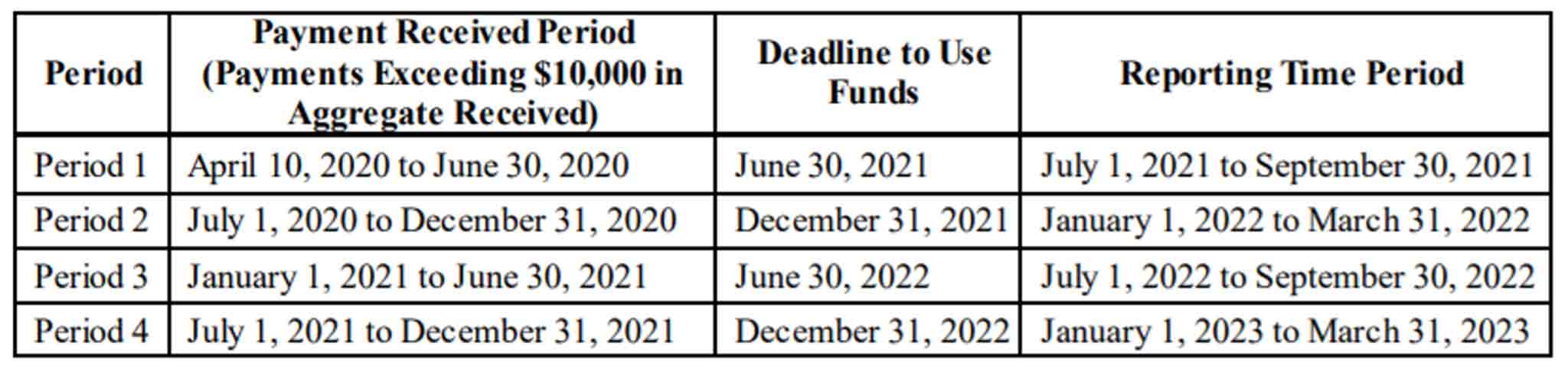

On June 11, 2021, HHS announced reporting requirements for providers who received $10,000 or more in any of the four rounds that PRF were granted. There are key categories of information that will be required along with timelines to report the information needed. Reporting will be done via a secure portal through HHS. HHS also plans to release a worksheet to help gather the information.

Important Dates

Each of the four rounds of PRF have specific dates that the funds need to be used by, as well as the corresponding timeframe to fulfill your reporting requirements. The below chart has the applicable due dates:

Qualified Expenses or Uses for Funds

It is important to have accurate records and receipts on file for the use of funds received from the PRF. If all funds were not used by the deadline for using those qualified funds, funds can be returned to HHS. The qualified uses for the funds are listed below.

- Mortgage/Rent: Payments related to mortgage or rent for a facility.

- Insurance: Premiums paid for property, malpractice, business insurance or other insurance relevant to operations.

- Personnel: Workforce-related actual expenses paid to prevent, prepare for or respond to Coronavirus during the reporting period, such as workforce training, staffing, temporary employee or contractor payroll, overhead employees, or security personnel.

- Fringe Benefits: Extra benefits supplementing an employee’s salary, which may include hazard pay, travel reimbursement and employee health insurance.

- Lease Payments: New equipment or software leases, such as fleet cars and medical equipment that is not purchased and will be returned to the owner.

- Utilities/Operations: Lighting, cooling/ventilation, cleaning or additional third-party vendor services not included in the “Personnel” sub-category.

- Other General and Administrative Expenses: Expenses not captured above that are generally considered part of general and administrative expenses.

- Supplies: Expenses paid for purchase of supplies (e.g., single use or reusable patient care devices, cleaning supplies, office supplies, etc.) used to prevent, prepare for and/or respond to Coronavirus during the reporting period. Such items may include PPE, hand sanitizer, supplies for patient screening or vaccination administration materials.

- Equipment: Expenses paid for purchase of equipment, such as ventilators, refrigeration systems for COVID-19 vaccines or updates to HVAC systems.

- Information Technology (IT): Expenses paid for IT or interoperability systems to expand or preserve Coronavirus care delivery during the reporting period, such as electronic health record licensing fees, telehealth infrastructure, increased bandwidth and teleworking to support remote workforce.

- Facilities: Expenses such as lease or purchase of permanent or temporary structures, or to retrofit facilities to accommodate revised patient treatment practices, used to prevent, prepare for and/or respond to Coronavirus during the reporting period.

- Other Health Care-Related Expenses: Expenses, not previously captured above, that were paid to prevent, prepare for and/or respond to Coronavirus.

- Lost Revenue: Lost revenue is also considered a use for the PRF. This will require much more information to quantify. If you intend to claim the use of funds for lost revenue, please contact us for the additional reporting requirement.

Other Important Information Needed

Aside from showing proper use of funds, HHS is requiring additional information be gathered for each reporting period you received more than $10,000 in Provider Relief Funds.

- Other Coronavirus Assistance Received: The application will require each business to disclose any additional assistance received during the period that eligible expenses could be use that was targeted for Coronavirus relief. Examples of relief required for the HHS reporting include:

- SBA or Department of Treasury Loans/Grants/Advances: Amounts received for the Paycheck Protection Program, Economic Injury Disaster Loans or Advances or other assistance provided through these agencies.

- FEMA Assistance: Any Coronavirus-related aid provided through FEMA.

- HHS Cares Act Testing: Any funds received from HHS for Coronavirus-related testing.

- Local, State or Tribal Assistances: Any funds, including grants and loans, provided at the local, state or tribal level.

- Insurance Assistance: Any amounts received from insurance policies to cover lost revenues.

- Other Assistance: Any other federal, state, local or tribal assistance received for Coronavirus-related reasons.

- Personnel, Patient and Facility Metrics: Reporting will be required for the following personnel, patient and facility metrics by quarter for CY 2019 through the current period of availability.

- Personnel Metrics: Total number of clinical and non-clinical personnel by labor category (full-time, part-time, contract, furloughed, separated, hired).

- Patient Metrics: Total number of inpatient admissions, outpatient visits (in-person and virtual), emergency department visits and facility stays (for long-term and short-term residential facilities).

- Facility Metrics: Total number of staffed beds for medical/surgical, critical care and other.

- Interest Earned on PRF: If relief funds were deposited into and held in an interest-bearing account, the dollar amount of interest earned will be required to be reported.

Child Tax Credit Advance Payments

In March 2021, the American Rescue Plan Act of 2021 (ARPA) was signed into law. The ARPA included changes to how families can receive their Child Tax Credit. Traditionally, the Child Tax Credit was a tax credit up to $2000 per qualifying child that was included on your annual tax return. The change made with ARPA is that qualified families can now receive half of the normal credit via monthly payments before filing their tax return. The intent of this change was to provide families with more income monthly instead of waiting until filing their tax return. The Child Tax Credit was also increased for 2021 to $3600 for children under 6 and $3000 for children between ages 6 and 17.

FAQs:

- Do I qualify for the Advance Child Tax Credit? The credit is based on your most recently filed return if it was a 2020 or 2019 tax return. If you qualified for the Child Tax Credit on your most recently filed return, you are Automatically Enrolled for the advanced credit.

- Will accepting the Advance Child Tax Credit impact my tax return? Potentially. Since you are receiving half of the credit in advance, this will reduce the normal credit you would have received on your tax return, and depending on other circumstances could reduce your normal refund or increase the amount you would owe.

- Do I have to take the Advance Child Tax Credit payments? No. The IRS has added an option to opt-out of receiving the advance payments. The opt-out option is available via the link below: https://www.irs.gov/credits-deductions/advance-child-tax-credit-payments-in-2021

- What if I no longer qualify for the Child Tax Credit? If you fall into a circumstance where you only claim a qualifying child every other year or your income has risen over the income limits, it is recommended to opt-out of the advance payments using the link above. If you receive the credit in advance and subsequently do not qualify for the credit when you file your tax return, the advance credit payment will be required to be paid back with your tax return.

- I/we had a child in 2021. Will they qualify for the Advance Child Tax Credit? Yes. The IRS plans to release an option using the online service from the link above to allow individuals to add children born in 2021. The ability to add additional children is tentatively scheduled for late summer.

- What should I do? If you are concerned about the impact taking the advance payments will have on your tax situation, it is recommended you schedule a tax planning appointment with our firm.

Two-month extension for PPP loans

On March 30, 2021, President Biden signed HR 1799—the PPP Extension Act of 2021. This bill extends the timeframe to apply for PPP Round 1 and PPP Round 2 loans from the original deadline of March 31 to May 31, 2021. Lenders have until June 30, 2021 to approve loans. However, applications need to be submitted to approved lenders by May 31, 2021.

Summary of American Rescue Plan Act of 2021 for Businesses

Below is a summary of the American Rescue Plan Act of 2021 (H.R. 1319) for businesses. The bill was signed into law on 3/11/2021.

Grants for restaurants and other food businesses (Restaurant Revitalization Grants)

Grants will be available in the near future for restaurants and other food and beverage businesses that are impacted by current economic conditions. These grants will be processed through the Small Business Administration (SBA).

Extension and expansion of the Families First Coronavirus Response Act (FFCRA) Sick/Leave Pay

The period that is available to claim the FFCRA Sick/Leave Pay has been extended from March 31, 2021 to September 30, 2021.

The credit can now include the employer’s share of Social Security and Medicare Tax.

The amount of wages an employer may claim per employee increased from $10,000 to $12,000.

The sick/leave time now includes a provision to allow employees to obtain the COVID-19 vaccine.

Extension and adjustments to the Employee Retention Credit (ERC)

The Employee Retention Credit has been extended from June 30, 2021 to December 31, 2021.

Clarifies that the ERC is not available for wages paid with PPP or PPP round two funds, shuttered venue assistance, or the Restaurant Revitalization Grants.

Taxation clarification on Restaurant Revitalization Grants or EIDL Advance

HR 1319 clarifies that Restaurant Revitalization Grants and the EIDL Advance are generally excluded from gross income and other tax-related calculations.

Shuttered Venue Operators Grant (SVOG)

HR 1319 includes an additional $1.25 billion for the Shuttered Venue Operators Grant (SVOG) program. It also allows eligible entities that receive a first or second draw PPP loan after December 27, 2020 to receive a grant. Previously, receiving or having open applications for both programs had been prohibited. With the passage of the new law, it is possible for venue operators to receive both a PPP loan and an SVOG, as long as the amount of the SVOG is reduced by the amount of PPP funds approved. SVOG eligibility requirements can be found through the SBA’s website.

Summary of American Rescue Plan Act of 2021 for Individuals

Below is a summary of the American Rescue Plan Act of 2021 (H.R. 1319) for individuals. The bill was signed into law on 3/11/2021.

Special information that may impact individuals who received unemployment in 2020:

For taxpayers who received unemployment in 2020 and have an Adjusted Gross Income of $150,000 or less, the first $10,200 of unemployment received is considered non-taxable. Adjusted Gross Income determination is made without including the unemployment received.

Our firm will provide future guidance to our clients that may be impacted.

This is only in effect for 2020. This does not impact your unemployment benefits received in 2021.

Individual tax provisions in 2021

Many of these tax provisions are for Tax Year 2021 only. Continuation of these items will require congress to extend these provisions.

2021 Recovery Rebates

As many individuals received Economic Impact Payments (stimulus checks) in 2020 and early 2021, another round of rebates will be distributed in the coming weeks. The eligible credit is $1,400 for single taxpayers and $2,800 for married filing joint filers. A credit of $1,400 is also available for eligible dependents. The income limits and phaseout for the recovery rebates will be determined by your 2020 tax return (if it has been filed), otherwise will default to income on your 2019 tax return.

There are a number of online calculators that can be used to determine the projected amount of the third stimulus check. If your 2020 return has been filed, you will need your Adjusted Gross Income amount, which can be found on line 11 of Form 1040. Otherwise, you will need your 2019 Adjusted Gross Income, which can be found on line 8b of Form 1040.

Here is a link to a calculator to calculate your recovery rebate: https://www.forbes.com/advisor/personal-finance/third-stimulus-check-calculator/

Child Tax Credit (currently in place for 2021 only)

The Child Tax Credit has been increased to $3,000 per child ($3,600 for certain children under 6). The child tax credit is now applicable to children under 18. The child tax credit in 2020 was $2,000 and applicable for children under 17.

Advance Payments of the Child Tax Credit

Along with changes increasing the Child Tax Credit, the Department of Treasury will also begin sending advance payments of the credit. This means you will get a monthly amount during the year instead of getting the full credit when doing your tax return.

This means your traditional tax refund may be lower starting in 2021 or the amount you traditionally owe may be more than usual.

The IRS will send you a tax form reporting all advance payments you received. This form will be required to complete your return.

For children born during the tax year, you will not receive an Advance Payment in the first year, you will receive the credit with your tax return.

Dependent Care Benefits (currently in place for 2021 only)

The Dependent Care Credit has multiple changes in place for 2021.

The calculation of the credit is now 50 percent of the eligible expenses.

The calculation traditionally has been 35 percent of eligible expenses.

The amount of eligible expenses is now $8,000 for one qualifying child or $16,000 for two or more qualifying children.

The amount of eligible expenses was $3,000 for one qualifying child or $6,000 for two or more qualifying children.

There is still an income phaseout for the credit. It was increased from starting to phase out at $15,000, to beginning to phase out at $125,000.

Starting in 2021, the credit is now a refundable credit. The credit traditionally was only allowed if the taxpayer had sufficient tax liability. Starting in 2021, the amount in excess of the tax liability will be included in the tax refund.

Example of how this impacts an individual. The credit now goes from a max of $1,050 for one qualifying child (35 percent of $3,000) or $2,100 for two or more qualifying children (35 percent of $6,000) to $4,000 for one qualifying child (50 percent of $8,000) and $8,000 (50 percent of $16,000).

Employer Provided Dependent Care Benefits (currently in place for 2021 only)

Dependent care benefits offered through an employer (reducing taxable income) have been increased for 2021. The amount of dependent care benefits that can be excluded has been increased from $5,000 to $10,500 per family.

Earned Income Tax Credit Expanded (currently in place for 2021 only)

The Earned Income Tax Credit has been expanded to most individuals 19 and over instead of 25 and older and will no longer have a maximum age of 65.

The credit income limits and phaseout have also been increased. The credit has also been expanded to certain married filing separate filers.

Student Loan Forgiveness (for Tax Years 2021-2025 currently)

Certain student loan debt forgiven between in 2021 through 2025 can be excluded from gross income. Currently, the amount of student loan forgiveness is considered taxable income.

Premium Tax Credit

The premium tax credit increases credits for individuals eligible for health insurance premium assistance under current law and provides credits for taxpayers with income below 400% of the federal poverty line. It removes restrictions for taxpayers receiving unemployment compensation anytime in 2021. Under these changes, no additional income tax is imposed for tax years beginning in 2020 where the advance credit payments exceed the taxpayer’s Premium Tax Credit (PTC).

Below is a summary of the stimulus relief for businesses that is part of the Consolidated Appropriations Act, 2021 (H.R. 133) which was signed into law on 12/27/2020.

Paycheck Protection Program second draw

Congress has created a PPP second draw available to smaller businesses that can show their business has been impacted by the pandemic. The second draw offers a similar package to the PPP offered out of the Cares Act earlier in 2020. There have been some changes and limitations put in place for the second draw including:

- Company size is smaller. Instead of 500 or less employees as it was in the Cares Act, the employee limits are reduced to 300.

- Companies will have to show a 25% or more reduction in revenue for an individual quarter in 2020 compared to 2019. This requires comparing quarterly financials for each quarter of 2020 to each quarter in 2019.

- Businesses that have 20% or more ownership by Individuals or other entities based in China or Hong Kong are ineligible for the PPP second draw.

- Businesses that were created or organized in China or Hong Kong or have significant operations in those countries are not eligible.

- Businesses engaged in political or lobbying activities are not eligible. This includes political research, political advocacy and public policy strategy companies

- Additional ineligible businesses include:

- Life insurance companies

- Lending institutions

- Passive businesses owned by developers and landlords that do not actively use or occupy the assets

- Businesses located outside the United States

- Pyramid sale distribution businesses

- Businesses with more than one-third of gross revenue from gambling

- Businesses involved in a federal illegal activity

- Private clubs that limit membership to members for any reason other than capacity

- Government-owned businesses (does not include businesses controlled by a Native American tribe)

- Businesses that have an associate that is incarcerated, on parole or probation, or has been indicted for a felony or crime or moral turpitude

- Businesses that present live performances that are sexual in nature or sell products, services or have displays that are sexual in nature

- Businesses that have defaulted on a federal loan or federally assisted financing

Calculation of loan: The loan calculation follows the same rules as it did under the Cares Act with the exception that you can choose to use payroll amounts from the calendar year 2019 or the 12 months immediately preceding the date of the loan application.

Hotels and restaurants

Borrowers with North American Industry Classification System (NAICS) codes starting with 72 (hotels and restaurants) can get up to three and one-half (3.5) times their monthly average payroll costs.

Deductibility of expenses forgiven under the PPP and PPP second draw

Under original guidance from the Department of Treasury, the expenses paid with funds from the PPP loans were not deductible. The passing of this new bill has clarified that the treatment of the forgiveness will be as tax-exempt income. The forgiveness amount will not add-back the forgiveness as income or result in any reduction in expenses paid.

PPP simplified forgiveness application

A simplified application (one-page) will be released for loans of $150,000 or less in the coming weeks. Currently, applications exist for loans of $50,000 or less only. We will provide more details when the Department of Treasury releases the new application.

Tax deduction for 100 percent of business meals starting January 1, 2021

Currently, a business may take a tax deduction of 50% of business meals. Starting on January 1, 2021 and ending on December 31, 2022, all meals from restaurants will be 100% tax deductible.

Employee Retention Tax Credit extension and changes

Changes have been made to the Employee Retention Tax Credit including:

- The credit is now allowed for wages paid through July 1, 2021. The original credit was due to expire on January 1, 2021.

- The credit limit of $10,000 wages per employee has been changed to $10,000 per employee per quarter for 2021.

- The credit limitation has been changed from 50% of qualified wages to 70% of qualified wages in 2021.

- The gross receipts test has been changed to comparing the respective quarter in the current year.

- The credit can also be taken if the payroll for the Employee Retention Tax Credit was not paid with forgiven (or forgivable) PPP funds.

- For 2020, the credit calculation has not changed, only that it can be taken in conjunction with the PPP from the above bullet.

- The changes to this tax credit are retroactive to the original Cares Act date of March 12, 2020.

Extension of Families First Coronavirus Response Act sick and family leave

The FFCRA sick and leave pay has been extended for qualified employees until March 31, 2021. The original Act was set to expire on December 31, 2020. All the same requirements will remain in place with the exception of date extension.

Below is a summary of the stimulus relief for individuals that is part of the Consolidated Appropriations Act, 2021 (H.R. 133) which was signed into law on 12/27/2020.

Second round of stimulus checks/direct deposits

Stimulus payments should start being processed in the coming week(s). Stimulus payments are $600 for each individual ($1200 per couple) and $600 for children age 17 and under. The amount of the stimulus payment will start to phase out at incomes of $75,000 (Single), $112,500 (Head of household) and $150,000 (Married filing joint or surviving spouse).

There are a number of online calculators that can be used to determine the projected amount of the second stimulus check. You will need your 2019 Adjusted Gross Income, which can be found on line 8b of form 1040. Here is the calculator from Forbes.

Enhanced unemployment benefits

Individuals on unemployment can receive an extra $300 per week for up to 11 weeks starting on December 26, 2020. The $300 is not retroactive and is good through March 14, 2021.

Earned Income Tax Credit changes for 2020 tax returns

Taxpayers that qualify for Earned Income Tax Credit, who have less earned income in 2020 than in 2019, can use their 2019 Earned Income to calculate their Earned Income Tax Credit.

Rollover of Flexible Spending Accounts (FSA)

The bill allows taxpayers to carry over amounts in their FSA to 2021 (from 2020), and then again into 2022 (from 2021). This covers both healthcare and dependent care FSAs.

Tax Year 2021 – Removal of Tuition and Fees Deduction

Starting in 2021, the Tuition and Fees Deduction has been eliminated. It has been replaced with a higher phase-out limit of the Lifetime Learning Credit. The new phase-out limits are $80,000 for single and $160,000 for joint returns.

Tax Year 2021 – Charitable deductions

Starting in Tax Year 2021, an individual who does not itemize deductions can also get an above-the-line deduction of $300 per return ($600 for a joint return) for cash donations. The suspension of cash donation limits was also extended through 2021.

Tax Year 2021 – Medical Expense deductions

Starting in 2021, to be able to claim medical expenses, the floor is officially 7.5%. This number has vacillated between 10% and 7.5%, but is now permanent at 7.5%.

On November 18, 2020, the Department of Treasury issued more clarifications regarding the deductibility of expenses paid with PPP funds that are ultimately forgiven. The Revenue Ruling 2020-27 clarified that expenses will be non-deductible for Tax Year 2020 as long as the taxpayer “reasonably expects” that there will be debt forgiveness on the loan—even if forgiveness isn’t determined by the end of the year.

Many PPP lenders are now accepting applications for forgiveness. Please note that Congress may still make changes to this ruling as senate finance committee chairman Chuck Grassley (R-IA) and ranking member Ron Wyden (D-OR) issued a bi-partisan statement calling on the Department of Treasury to reconsider this position.

Remember, we are here to help! Forgiveness application submission is not a simple task. We can assist you to ensure your application is accurate and that you put yourself in the best position to gain maximum loan forgiveness.

On October 8, 2020, the Department of Treasury introduced an easier Loan Forgiveness Application for businesses that received PPP loans of $50,000 or less. This new application does not require any calculations for Loan Forgiveness and borrowers are not subject to any wage or FTE reductions. All relevant payroll reports and records of other qualified expenses should still be kept on file, as they could be requested in the future by the SBA.

Links are provided below to access these new, simpler forms. Our firm is here to help if you have questions about your PPP Loan Forgiveness.

Beginning August 10, 2020, the SBA will begin accepting PPP loan forgiveness applications. While August 10 is the date set by the SBA, it is important to check with your lender, as many lenders may have set their own unique date for accepting forgiveness applications.

It’s also important to note that there is pending legislation in Washington that could allow automatic forgiveness of loans that are $150,000 or less. At this time, there is no guarantee the legislation will pass.

We will continue to monitor the situation and work to keep clients updated.

As promised, we have kept a close watch on new legislation that affects the Paycheck Protection Program (PPP) and have an important update for you.

Recent legislation (titled HR7010) has passed, offering adjustments to PPP loans—particularly regarding forgiveness calculations. Key changes are as follows:

- Covered time period extended—The period of time to use loan money has been extended from 8 to 24 weeks. This means that you have more time to apply funds to qualified expenses that maximize loan forgiveness.

- Social Security payments deferred—Originally under the Cares Act, employers who received the PPP Loan could not also defer employer social security tax payments. HR7010 adjusted this. Now, any employer with social security payments due between March 27, 2020 and December 31, 2020 can pay half of the amount due by the end of 2021 and the remainder by the end of 2022.

- Loan payment deferral extended—The original 6-month deferral for repayment of PPP loans has been extended to 10 months. Payments are only required on the amount of the loan that is not forgiven.

- Payroll threshold adjusted—Originally, the Department of Treasury and the SBA determined that 75 percent of a PPP loan had to be used for payroll in order for the loan to be forgiven. The 75 percent threshold has been adjusted to 60 percent. In a statement on 06/08, Treasury clarified “If a borrower uses less than 60 percent of the loan amount for payroll costs during the forgiveness covered period, the borrower will continue to be eligible for partial loan forgiveness, subject to at least 60 percent of the loan forgiveness amount having been used for payroll costs.” This means that borrowers are still eligible for partial loan forgiveness even if they use less than 60% of the loan amount for payroll costs.

- Safe harbor date extended—The original Cares Act included safe harbor exceptions to restore or attempt to restore full-time employees and any pay reductions by June 30, 2020. These exceptions still exist, but the date to restore has been adjusted to December 31, 2020.

- Loan term date extended—All new PPP loans effective after the passing of HR7010 will have a five-year term. Businesses that received a loan prior to the new legislation can adjust the loan term from two to five years. Individuals will need to work with their lender to amend loan terms.

We hope this update helps. Again, we will continue to closely monitor new legislation and inform you on the key changes that may affect your PPP loan.

- Maximizing PPP Loan Forgiveness fact sheet – 07/09/2020

- Calculate your second stimulus check – You will need your 2019 Adjusted Gross Income, which can be found on line 8b of form 1040.

- Treasury website’s CARES Act page which includes:

- PPP Loan Forgiveness Application for loans $50k or less

ApplicationInstructions - PPP Loan Forgiveness (updated 06/16/20):

ApplicationInstructions - PPP Loan Forgiveness Form EZ:

ApplicationInstructions - Paycheck Protection Program overview

- Paycheck Protection Program Borrower Application form (updated 06/12/20)

- Helpful information for borrowers

- PPP Loan Forgiveness Application for loans $50k or less

- Stimulus check information

- Calculate your stimulus payment

(Note: If your 2019 tax return has been filed, your AGI is on line 8b of your 2019 1040. If you’ve not filed yet, use your 2018 return. Your AGI on the 2018 1040 is on line 7) - Check on the status of your Economic Impact Payment

- Calculate your stimulus payment

- COVID-19: Economic Injury Disaster Loan Application (EIDL):

- SBA Form 413 – Personal Financial Statement

- Form 4506-T – For business, personal and any related businesses

- SBA Form 2202 – Schedule of Liabilities

- FFCRA Paid Sick Leave Request form

- Emergency Relief Small Business Information (04/11/2020)

IRS extends additional federal tax deadlines to cover individuals, trusts, estates, corporations and others

Last month, the IRS announced that taxpayers have until July 15, 2020 to file and pay federal income taxes (originally due on April 15, 2020). On April 9, 2020, the IRS expanded this tax relief effort to additional returns, tax payments and other actions.

As a result, extensions generally now apply to all taxpayers that have a filing or payment deadline falling on or after April 1, 2020 and before July 15, 2020. Individuals, trusts, estates, corporations and other non-corporate tax filers qualify for the extension. This means that anyone, including Americans who live and work abroad, can now wait until July 15, 2020 to file their 2019 federal income tax return and pay due taxes.

Estimated tax payments

Additionally, any individual or corporation with a quarterly estimated tax payment due on or after April 1, 2020 and before July 15, 2020, can wait until July 15, 2020 to make a payment—without penalty. This means that estimates normally due June 15, 2020 are now due one month later on July 15, 2020.

Extension of time to file beyond July 15

Individual taxpayers who need additional time to file beyond the July 15 deadline can request an extension to October 15, 2020.

Note: This is an extension to file the tax return. It is not an extension to pay taxes owed. Taxes owed are still due by the July 15, 2020 deadline.

March 29, 2020 – last updated (04/03/2020)

The following represents a summary of the recently signed into law CARES Act—also referred to as the Stimulus Package. Specifically, we are providing a summary of the Paycheck Protection Program.

Title 1 of the CARES Act, entitled “Keeping American Workers Paid and Employed Act,” provides relief for small businesses and their employees who are adversely affected by the COVID-19 outbreak. The key provision in this Act is the Paycheck Protection Program—an emergency lending facility to provide small business loans on favorable terms to borrowers impacted by the current economic state.

PAYCHECK PROTECTION PROGRAM – KEY POINTS

The following offers highlights of the Paycheck Protection Program that small business owners need to be aware of and consider as they move forward:

- Available to businesses with 500 employees or less.

- Loan period ranges from February 15, 2020 through June 30, 2020.

- Loan amount equates to 2.5 times average monthly payroll expenses for 12 months prior to the loan origination—up to $10 million.

- Loan interest rate is 1.0% (Treasury changed from 0.5% on 04/02/2020.)

- Loan duration is 2 years. (Treasury changed from a max of 10 years on 03/31/2020.)

- Loan forgiveness is available—A borrower is eligible for loan forgiveness equal to the amount spent on the following items, during the eight-week period beginning on the loan origination date:

- Payroll costs

- Mortgage interest incurred in the ordinary course of business

- Rent paid based on a leasing agreement

- Payments for utilities—including electricity, gas, water, transportation, telephone or internet

- Additional wages paid to tipped employees

Note: The loan forgiveness amount can be reduced if there is a reduction in the number of employees or a reduction of greater than 25% in wages paid to employees.

Note: The loan forgiveness amount can be reduced if there is a reduction in the number of employees or a reduction of greater than 25% in wages paid to employees.

Note: To have loan amounts fully forgiven, at least 75% of forgiveness amount calculated must be for payroll costs. (This is a NEW requirement from the Treasury as of 03/31/2020.)

- Collateral is not required to secure the loan.

- No personal guarantee is required to secure the loan.

- Loan repayments are automatically deferred for six months and up to one year. This includes interest, fees and loan principal.

- Payment Protection Program loans are applied for through approved banks. The SBA may administer some loans based on viability.

- For businesses that have been denied SBA loans previously, lending requirements are more lenient.

CARES ACT – ADDITIONAL KEY POINTS

Employee Retention Payroll Tax Credit

- The Employee Retention Payroll Tax Credit cannot be used in conjunction with the Payroll Protection Program or any other loan where payroll costs are forgiven.

- Employee retention credit is equal to 50% of qualified wages with a cap of $10,000 wages. Maximum credit per employee is $5000.

- The employer’s gross receipts must be 50% or less than the same calendar quarter in 2019 to qualify.

- For employers with 100 or less employees, qualified wages are defined as wages paid for all employees during the period—whether they were able to work or not. For employers with 100 or more employees, qualified wages are defined as wages paid to employees not providing services.

Deferral of Employer Social Security Taxes

The deferral of employer social security taxes cannot be used in conjunction with the Payroll Protection Program. This allows an employer to defer their portion of Social Security taxes from March 27, 2020 to January 1, 2021. 50% is due by December 31, 2021 and the remainder by December 31, 2022.

Bonus Depreciation

This allows employers to expense qualified improvement property under the section 168 bonus depreciation rules.

March 28, 2020

The following represents a summary of the recently signed into law CARES Act—also referred to as the Stimulus Package.

RECOVERY CHECKS – KEY POINTS

Recovery check distribution amounts—Single taxpayers will receive $1,200 and joint taxpayers will receive $2,400. There is an additional $500 for each qualifying child.

The recovery check is considered a credit for 2020, but paid in advance.

The amount is reduced (but not below zero) by 5% of each dollar a person’s adjusted gross income (AGI) exceeds. Consider the following:

- Married filing joint: $150,000 (AGI over $198,000 does not qualify)

- Head of household: $112,500 (AGI over $146,500 does not qualify)

- Single: $75,000 (AGI over $99,000 does not qualify)

Consider the following example:

- A married couple with no children has an AGI of $190,000.

- $190,000 is $40,000 above the $150,000 amount shown above.

- The couple’s check is reduced by 5% of $40,000, which is $2000.

- Therefore, they would receive a check for $400. (i.e., $2400 – $2000 = $400)

Other key details for recovery check eligibility include:

- Nonresident aliens are not eligible for the rebate.

- If a taxpayer has an outstanding debt (which the IRS would typically offset a refund by paying that debt), recovery dollars will not be used to offset that debt.

- Amount will be direct deposited into the account on the last filed return. Every taxpayer will receive a letter indicating their recovery check was dispersed. If the letter is not received, there will be a specific phone number to call to have the check re-issued.

- AGI will be accessed from 2019 returns if filed at the time of determination. Otherwise, 2018 returns will be used. Taxpayers who have not filed a return will not receive a check unless they did not file because they only have SSA-1099 or RRB-1099 (social security). The Treasury Department will review those forms for 2019 and issue the appropriate amount via check.

UNEMPLOYMENT – KEY POINTS

Any employee who was furloughed or part of a layoff is eligible for state unemployment. Details are as follows:

- Unemployment amount via the state typically ranges from 30-50% of the standard wage, depending on the state.

- The amount a person will receive for unemployment over four months will be the amount the state would already provide, but increased by $600 per week through July 31, 2020. For example, if a person is eligible for $300 weekly, they will receive $900 per week over four months or through July 31, 2020, whichever comes first.

- If an employee is already unemployed due to COVID-19, the $600 weekly additional payment will be paid retroactively.

- Self employed individuals, independent contractors, and gig workers are eligible for unemployment under this program.

RETIREMENT DISTRIBUTIONS – KEY POINTS

Ability to withdraw up to $100,000 retirement in 2020 for COVID-19-related purposes without 10% penalty—The distribution is taxable over a 3-year period unless electing to pay it back within 3 years. This essentially equates to a loan unless it is not paid back within the 3-year timeframe. This rule applies to individuals:

- Diagnosed with COVID-19

- Who have family (spouse or dependent) who have been diagnosed with COVID-19

- Who have adverse financial consequences in relation to COVID-19

- Who include the distribution in taxable income (unless they elect the 3-year payback)

Waived required minimum distributions (RMD) from individual retirement accounts—The required minimum distribution for 2020 has been waived.

This also applies to retirees who turned 70 1/2 in 2019 and are required to take their RMD by 4/1/20. If the retiree that turned 70 1/2 in 2019 still intends to take their RMD, this must happen by April 1, 2020—otherwise, the same penalty for late withdrawal will be applied.

CHARITABLE CONTRIBUTIONS – KEY POINTS

Above-the-line charitable contribution—For tax year 2020, if a taxpayer does not itemize deductions, they can deduct up to $300 in addition to standard deduction for cash charitable contributions (no stock contributions).

Charitable contribution limitation by AGI—The 60% adjusted gross income limitation has been removed for 2020 (other than from donor advised funds).

In an effort to provide continued clarity around changes to tax law, we are offering this update to our previous tax announcements. As such, we have removed a few of our previous tax update posts.

Below, you will find a list of frequently asked questions in reference to the Internal Revenue Service’s (IRS) Notice 2020-18 (PDF). In this Notice, the Treasury Department and the IRS announced special Federal income tax return filing and payment relief in response to the ongoing COVID-19 emergency.

You can review the IRS page for additional information here.

March 21, 2020

Under the recently enacted Coronavirus Preparedness and Response Supplemental Appropriations Act (the Act), small businesses that have suffered substantial economic injury as a result of COVID-19 can apply for low-interest federal disaster loans through SBA. Small businesses and nonprofits can apply for working capital loans of up to $2 million.

We’ve highlighted the following key details of the Act for you here, but you can also learn more by visiting the COVID-19 disaster assistance page on SBA’s website.

- State governors must first request access to the Economic Injury Disaster Loan program. Once the declaration is made, information on the application process for disaster loan assistance will be made available to affected small businesses within the given state.

- Loans carry an interest rate of 3.75% for small businesses and 2.75% for nonprofits.

- Loans can be used to cover accounts payable, debts, payroll and other bills.

- Loans can be offered with long-term repayments in order to keep payments affordable—up to a maximum of 30 years. Terms are determined on a case-by-case basis.

- Businesses will apply for loans online and select “Economic Injury” as the reason for seeking assistance.

- SBA offers disaster assistance via its customer service center. If you have questions or want to check if your state is eligible, contact U.S. Small Business Administration via phone at 800-659-2955 (TTY: 800-877-8339) or e-mail disastercustomerservice@sba.gov.

The coronavirus situation is changing rapidly, as are the updates to various relief efforts. We will continue to monitor news and keep you updated as clarification is provided.

If you have questions, be sure to reach out to us. Our entire team is here to support and guide you!

March 20, 2020

“The Families First Coronavirus Response Act” (FFCRA), which goes into effect April 2, 2020 and expires December 31, 2020, responds to the coronavirus outbreak by providing additional assistance in the areas of COVID-19 testing, sick leave, food assistance and more. We’ve compiled key details of FFCRA that we believe you need to know.

In summary, the Act:

- Requires private insurance plans to provide free COVID-19 testing.

- Requires employers to provide emergency paid sick leave to workers affected by COVID-19 and expands family and medical leave.

- Offers increased funding for state unemployment insurance, food stamp and nutritional programs.

More specifically, here’s what FFCRA means for both business owners and employees in the areas of sick leave and expanded family and medical leave.

- Employees are eligible for up to two weeks of sick leave (full pay for self, 2/3 pay for family care) for illness, quarantine or school closures.

- Employees are eligible for up to 12 weeks of FMLA leave for school closures (10 days unpaid and then up to 10 weeks at 2/3 pay).

- FMLA expansion covers:

- Employers with fewer than 500 employees.

- Employees who have been employed for at least 30 calendar days (some exclusions may apply).

- Employees who must care for children under the age of 18 in the event of school and place-of-care closures or if care provider is unavailable due to a public health emergency with respect to COVID-19.

- Emergency paid sick leave covers:

- Employers with fewer than 500 employees.

- All employees no matter the length of employment (some exclusions may apply).

- Small businesses with fewer than 50 employees may qualify for exemption from the requirement to provide leave due to school closings or child care unavailability if the leave requirements would jeopardize the viability of the business as a going concern.

Department of Labor Links:

- FFCRA: Questions and Answers

- As part of the FFCRA, employers are required to provide notice to employees of the Act’s provisions. An example of the required notice has been made available by the Department of Labor and can be downloaded here: FFCRA NOTICE TO EMPLOYEES.

- In addition, the Department of Labor has made available a FAQ page discussing the notice requirements: FFCRA NOTICE – FAQ.

The coronavirus situation is changing rapidly, as are the updates to various relief efforts. We will continue to monitor news and keep you updated as clarification is provided.

If you have questions, be sure to reach out to us. Our entire team is here to support and guide you!

Tax & Business Consultants is a full-service tax, accounting, payroll, and consulting firm serving Blair, Nebraska and its surrounding areas.

Blair Office

- 229 S 17th St

- Blair, NE 68008

- Phone: 402-426-4144

- Fax: 402-426-4156

Lyons Office

- 105 N Main St.

- Lyons, NE 68038

- Phone: 402-808-8300